What is the crypto inflation rate in 2022? The user gnarley_quinn of the famous community site Reddit had a very good idea to calculate the inflation rates for 16 different cryptocurrencies. Not finding a tool or sources reliable enough to calculate inflation rates, the Internet user decided to do it himself and share his data with the rest of the Internet. Let's take a look at how these rates were calculated and what they mean for your investments.

An inflation rate to take into account before investing

The Internet user describes what the inflation of crypto is and what it can be used for. As a reminder, inflation is based on the principle of supply and demand. Quite simply, if the supply exceeds the demand, the price of the crypto will fall. A coin's inflation is therefore the rate at which it is currently increasing its supply.

Concretely, if crypto has an inflation rate of 5%, the following year there will be 5% more crypto available on the market. Conversely with the deflation rate where we will find fewer tokens than the previous year.

The circulating supply of a token can decrease for several reasons, for example via a “token burn” or even by the loss of access keys to a wallet. The supply, on the other hand, can increase with mining, rewards, staking, or even the unlocking of blocked tokens.

You should also be aware that the effects of inflation on cryptos can have positive sides. For young projects, this keeps the buying pressure high. For example, in 2012 Bitcoin had an inflation rate of 32% and only 15% the following year.

The Reddit user concludes that for a project of less than a year it is profitable to continue investing if there are still two figures of inflation. After this period, it seems risky to invest in a token where inflation is more than 10%.

Finally, the maximum token supply of crypto also plays an important role in understanding inflation. Indeed, some crypto has a maximum number of tokens in circulation while others have no limit which can increase inflation.

How was the inflation of each crypto calculated?

The redditor in question took the data on Coinmarketcap for September 5, 2021, and September 5, 2022. Then he calculated inflation simply with this formula:

Inflation rate % = (Quantity of tokens in circulation in 2022 / Quantity of tokens in circulation in 2021)-1

The deflation of Binance (BNB) can be explained by the practice of “token burn”. Indeed, almost 6,000,000 tokens were burned between 2021 and 2022. This represents more than 1.6 billion dollars if we take the current price on September 6, 2022.

Binance recalled that this burn was based on a self-combustion mechanism, a mathematical formula that allows tokens to be withdrawn from circulation. Thus, this mechanism brings more transparency and predictability to crypto users.

On contratio, the incredible inflation of the Luna Classic stablecoin can be explained by the unanchoring of the UST.

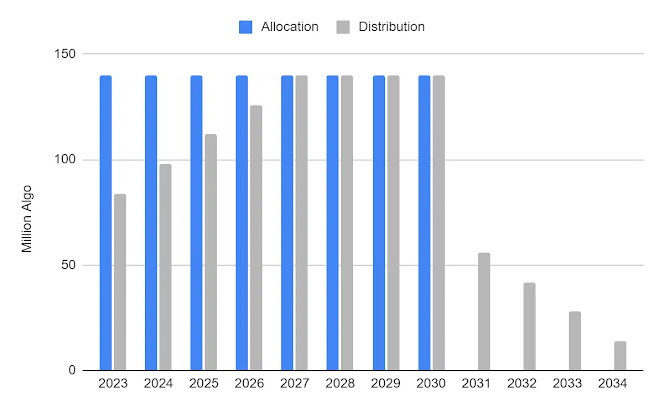

The same goes for Algorand, which borders on an inflation rate of 96%. According to some analysts, this inflation is controlled by the creators of the crypto and is part of a long-term project.

It happens that cryptos publish their own inflation rate. This is the case for Bitcoin, which estimated a rate of 1.77%, and which almost hit the bull's eye since the real inflation rate is 1.78%. Despite a dizzying fall in recent months, BTC has been able to keep a relatively stable inflation rate.

0 Comments