Crypto World Holds Its Breath Ahead of FOMC Announcement. The crypto world has its eyes on the Federal Open Market Committee (FOMC). This organization of the American Federal Reserve has a great influence on the crypto markets. He is due to make an announcement today on September 21 where crypto investors fear a tightening of monetary policy.

Let's see together what the likely scenarios following this announcement.

Correlation between rising interest rates and falling Bitcoin prices.

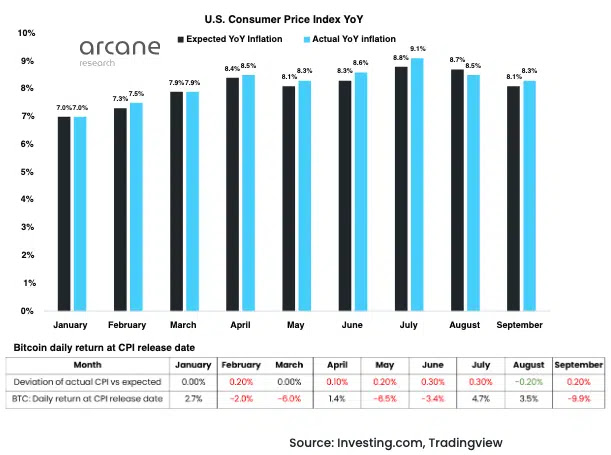

Bitcoin is closely linked to inflation and stock market prices. Indeed, last week its price fell alongside a decline in stock market shares. The Consumer Price Index or consumer price index calculates the average price level of services and goods consumed by households. It, therefore, serves as a measuring tool for inflation.

Excluding this, it exceeded 0.2% this year with inflation of 8.3%. It has been shown that Bitcoin experienced a massive drop in reaction to the reversal of this index (CPI).

In 2022, the drop that Bitcoin experienced last week was the worst of the year. This fall is linked to announcements by the FOMC that are out of step with investors' expectations and uncertainty. According to research and analysis organization Arcane Research, the cryptocurrency market is expecting a sharp rise in interest rates today.

An estimate of the increase in interest rates at around 75 points.

Today, the markets expect a 75 basis point increase with an 80% probability. Remember that a basis point (BPS) corresponds to one-hundredth of a percentage (0.01%).

That is to say that an increase of 75 points would correspond to an increase of 0.75% in interest rates. For example, during the 2008 crisis, interest rates were 5.21%. While today they are “only” at 2.50% but were at 0.25% at their lowest in 2022.

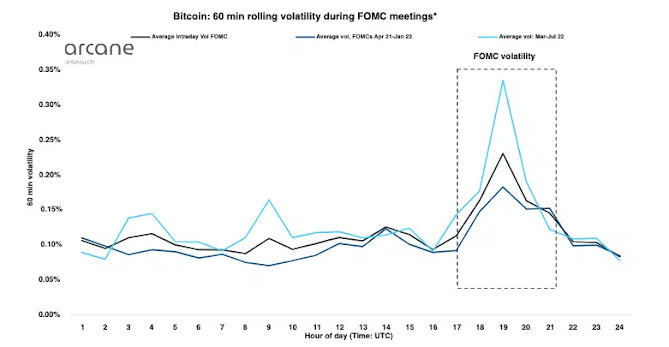

Each FOMC decision has created volatility in Bitcoin prices. Thus, analysts are warning investors by preparing them for a potential new explosion in Bitcoin volatility.

If we look at the curves of the NASDAQ and S&P 500 stock exchanges, we see that Bitcoin tends to closely follow these during key macroeconomic events such as FOMC announcements. It would therefore also be interesting to follow the traditional stock markets to understand the evolution of Bitcoin.

What strategy to adopt for the announcement of the FOMC?

To help investors make the fairest and safest trades possible, analysts at Arcane Research have released a chart to guide them.

In this diagram, the researchers calculated what happens during the 60 minutes following the FOMC press releases. It should be noted that volatility in finance is always perceived as a high risk.

“Day Traders”, ie those who seek to make a profit by buying and reselling over short periods, are those who suffer the most from the FOMC announcements. Indeed, the volatility of the Bitcoin price during FOMC announcements makes short-term investing very uncertain. Therefore, today's announcement is likely to generate exceptionally high volatility.

If ever the base index reaches 100 points, we can expect a downward momentum in the markets. However, if the index only increases by 75 points, we can expect a positive short-term effect on the value of Bitcoin.

Over the long term, intraday volatility does not seem relevant. But over the medium term, the Federal Reserve's bullish outlook and cycle play a major role in determining Bitcoin's momentum.

BigCheds, a Twitter user with more than 280,000 followers and author of books on crypto gives us his analysis. He studied the price trend of Bitcoin and noted that its value should hold above $18,923. If BTC were to drop below this threshold, it would imply a downtrend reversal.

The current Bitcoin price.

As of this writing, Bitcoin is down 1.16% in the past 24 hours. Its value is now $18,991.19. Now, it remains to be seen how the crypto world and more specifically Bitcoin will react to the FOMC announcement.

0 Comments