Will Bitcoin Boom or Crash in the Face of Powell's Speech? After heavy losses last week following a failed attempt to break through the key $25,000 threshold, Bitcoin is stabilizing this week. Cryptocurrency investors are wondering what the direction of BTC's next significant move will be.

However, the indices and signals seem contradictory, with elements that point to a rebound in Bitcoin, others that raise fears of further losses, and a possible passage below the major threshold of $20,000.

Blockchain data points to mixed outlook for Bitcoin

For example, according to blockchain data analytics firm Glassnode, USDC deposits to cryptocurrency trading platforms hit a 13-month low today. However, you should know that stablecoins such as USDC are deposited on crypto platforms with the aim of using them to buy other cryptocurrencies.

Indeed, stablecoins act as a liquidity line on the accounts that traders open on crypto exchange platforms. Therefore, low USDC deposits with exchanges reflect low investment intentions in cryptocurrencies, which does not argue for a Bitcoin rebound.

On the other hand, again according to data provided by Glassnode, the Bitcoin positions of Hodlers (those who have the firm intention of holding their Bitcoins for the long term) hit an 11-month high today. Note that cryptocurrencies held in “cold” crypto wallets, or simply outside trading platforms, are considered cryptocurrencies held by Holders.

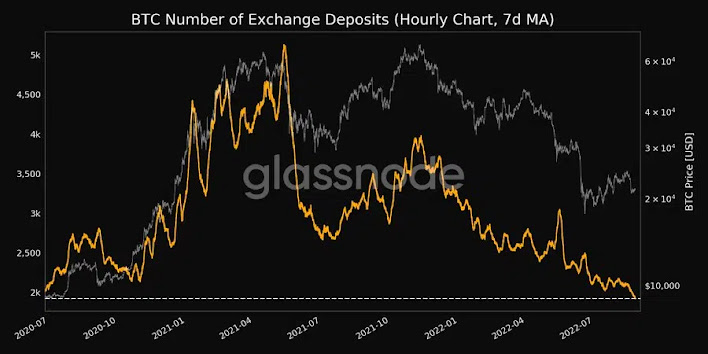

This analysis is confirmed by the fact that the amount of Bitcoins deposited with exchanges reached a 4-year low on Thursday morning, showing that traders are withdrawing their Bitcoins from exchanges to store them for the long term in crypto wallets.

In other words, the data shows that traders have no intention of betting heavily on Bitcoin, but also no intention of panicking and selling their BTC.

Jerome Powell's intervention in Jackson Hole will be decisive for Bitcoin

When it comes to Bitcoin's likely move for Friday, Fed Chief Jerome Powell's speech at the annual Jackson Hole symposium will be of critical importance.

Indeed, US monetary policy has had a very clear influence on the price of Bitcoin and other cryptocurrencies since the beginning of the year. Fed rate hikes, which boost the attractiveness of the Dollar and hurt the economy, prompting a flight to safe havens, have been the main factor behind Bitcoin's slide since its record highs last year.

However, Powell's speech this Friday at 4 p.m. is anxiously awaited by investors, who will be looking to know if the Fed will maintain a strongly hawkish position with a rate hike of 0.75% for the next meeting in September, or if it plans to start to slow monetary tightening with a Fed Funds rate hike limited to 0.50%.

In the first case, it will probably be necessary to expect further losses of Bitcoin. However, the losses could remain limited, knowing that this is a scenario already widely anticipated. On the other hand, if Powell's words sound less hawkish than expected, Bitcoin could largely benefit.

Technical thresholds to watch on BTC/USD today

Finally, regarding the important thresholds to watch on Bitcoin in the event of a strong reaction to Powell's speech, it should be noted that the $20,700/20,800 zone is important short-term support, which has already been tested on the 18 and July 26, as well as August 20 and 21.

Then, the next support to consider will be the major psychological threshold of $20,000. On the upside, the first potential chart hurdle is the psychological threshold of $22,000, before a more important threshold at $22,400 (July 8 high, July 21 low, and August 4 low). This is followed by the $23,600/$700 and then $24,250 areas, before the key $25,000 threshold and last week's high at $25,212.

0 Comments