Traditionally seen as a strongly bullish month for Bitcoin and digital assets, October is, for now, synonymous with dead calm. But certain elements such as the macroeconomic or geopolitical context could give way to the storm. Unless it's something more specific to Bitcoin like the monthly close that sets things on fire. Here are several things to consider this week around the world's largest crypto asset.

Has Bitcoin become a stablecoin?

The very low volatility of the past few weeks has caused some to ironically refer to Bitcoin as the new stablecoin . In recent weeks, the mother of cryptocurrencies has even shown greater stability than some fiat currencies. A height! As shown in the following chart, taken from the Tradingview platform.

A graph that shows the weekly close of Bitcoin since the beginning of the year:

For 6 weeks, the market has been absolutely calm as shown by the extremely flat candles. For those who are betting on a major movement, upwards or downwards, this calm would only reinforce the amplitude of the movement to come.

With the underlying idea that the power of the movement could be guided by the duration of this crossing of the desert. In other words, the longer Bitcoin waits, the more powerful the move is likely to be.

While a very volatile month for the price of Bitcoin, October (also called “Uptober” by cryptophiles) is currently very disappointing. Some predict that the movement could settle in November. Either way, the bulls seem to have their work cut out for them, as the asset has remained firmly locked below the $20,000 resistance for several sessions.

For Michaël Van de Poppe, founder of the trading company Eight, Bitcoin is about to experience a major movement. He recently told these followers that:

"The week ahead is a big one with all the happenings making it almost inevitable that this range will break out. I watch this final resistance. She has to break, and then the party can begin."

An opinion more or less shared by the trader and analyst Jackis who predicts for his part, a “wild” month of November for Bitcoin. With a strong return to volatility. However, Jackis does not specify whether the movement will be bullish or bearish.

Uptober does not keep its promises!

While the month of October 2021 had seen the price of Bitcoin increase by almost 40%, the 2022 vintage is not so good. With a loss of 0.36%, October could see Bitcoin post losses for the third time in the last 10 years.

The table below illustrates October's underperformance compared to other years:

The importance of the FED and the ECB!

For weeks, the crypto market is fueled and guided by the monetary policies of central banks. Themselves result from the figures of the real economy.

On October 28, the market could react to the publication of the PCE index in the United States for the month of September. If this index, which details personal consumption expenditure, is less impactful than the CPI, the date of publication could reinforce its influence.

Indeed, the following week, the FED must meet again to decide on new rate hikes to come. No one doubts that the federal institution will take into consideration the figures of the PCE index in its decision.

While the market is expecting another 75 basis point rate hike, there are already rumors of a possible softening of the Fed's stance. If so, this could well have the effect of a significant boost for risky markets. Anyway, cryptophile James Bull is a big believer in this theory:

"We are in the 11th month and the FED is considering stopping the rise in interest rates."

The analyst also notes that a bear market around Bitcoin lasts an average of 12.5 months. Started last November, so we would be close to a low point according to this theory.

For his part, Charlie Bilello, CEO of Compound Capital Advisors, estimates that the rate cuts will start in December and accelerate from the start of 2023.

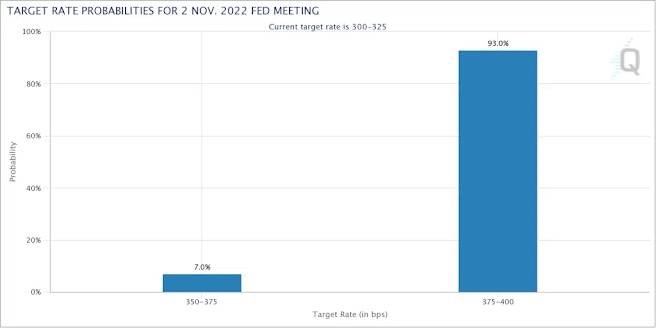

Either way, the current consensus seems to be for another 75 basis point rate hike. As shown in the diagram below:

But it is interesting to note that the consensus is moving towards a more reasoned increase. If 7% of economic actors anticipate a rise of 50 basis points, they were only 2% to imagine this outcome a week ago.

At the European level, the ECB will organize a press conference next Thursday. For the Old Continent, the market also seems to be anticipating a rate hike of 75 basis points. In some member countries of the Union, inflation has reached peaks. Exceeding 20% in some places.

The hash rate could play a crucial role!

Despite the bear market and the collapse of the Bitcoin price, the hash rate continues to explode. A rise in the hash rate, which measures the computing power of the entire network, therefore means that miners are devoting more and more computing power to the blockchain.

In a context where margins were already low, this reduces them even more. For many small miners, the situation could quickly become unbearable. Especially since at the global level, the price of electricity is following an upward slope. As William Clemente, co-founder of research firm Reflexititvy Research, explains:

"I wonder who is this (these) entity(ies) who think(s) that it is advantageous to mine with the price of BTC which is down by 70%, energy prices which are high, and the price of hash which has never been so low. I wonder if it is one or more big players with excess energy or access to very cheap energy."

If the identity of the entities still remains mysterious, these would come from Russia. As Steve Barbour put it:

"Russia is where the hashrate goes. Manufacturers have admitted to selling more ASICs to Russia recently than to the US and guess what happens when you blow pipelines and power bottlenecks? Bitcoin solves the problem."

According to MiningPoolStats, the hash rate today would be 270 exahashes per second. This new increase is at the origin of the increase in the difficulty of mining.

Today, the difficulty has increased by another 3.44%. Bringing it to its highest historical level, close to 37 trillion. The old adage that price follows hash rate seems well-worn today.

Capitulations multiply!

The Game of Trades Twitter account summarizes the situation: “the capitulations are here”. In particular, exposing that the total supply of BTC in loss is now at its second-highest all-time high, taking into consideration a 30-day moving average.

According to Glassnode, this would be around $8 million and the second-highest all-time high after 2019. As seen in the chart below.

Losing sellers are therefore multiplying. Some followers, however, qualified the statement by indicating that the figures were lower when considering only the supply in circulation. At the same time, Glassnode notes that the share of Bitcoin dormant for more than 5 years is at its maximum level: above 25%.

0 Comments