In this XTB review, you will discover the trading offer of the online broker XTB that we have tested for you: markets and financial products offered, prices, platform, and educational tools. Finally, find our XTB 2022 review with the strengths of this stock broker's offer and the audience targeted by this broker.

XTB: History and 2022 key figures of the online broker

Present in France since 2010, XTB France is the French branch of the international investment group X-Trade Brokers DM SA. (XTB) created in 2002 and present in 16 countries. This international investment group with 389,000 clients worldwide is notably one of the main players in the CFD market in Europe and around the world.

In fact, the broker XTB is one of the leaders in the CFD market in countries such as the Czech Republic, France, Germany, Poland, Portugal, Slovakia, and Spain. Many educational materials and a very complete range of trading tools characterize this online broker which will appeal to the most knowledgeable investors.

XTB also offers in its offer the shares at 0% commission of 16 markets, i.e. more than 2,000 securities and more than 200 ETFs directly.

XTB Review: how to invest in many financial markets with the XTB broker in 2022?

The XTB broker offers a wide choice of CFDs and financial instruments allowing you to invest the stock market on the stock market and the stock market indices but also in the commodity market, the currency market as well as on Bitcoin and other cryptocurrencies.

Note: XTB has chosen to limit the optimum number of underlying assets to maintain the balance between assets actually used by active investors and market liquidity.

XTB Review: what are the technical trading tools and services offered by XTB in 2022?

A palette of assets offered on a state-of-the-art platform is the first step to entering the future of trading and investing. Thus, the broker XTB provides investors with a whole range of tools to manage their investments in real-time:

- xStation5 trading platform: customizable, fast, and intuitive, providing access to technical analyses, a trading mode via API, and economic news: Reuters, videos, economic calendar;

- or its mobile version of the xStation Mobile.

In addition, the broker XTB is particularly involved in the training and support of its users and offers its clients numerous educational materials listed in the "Training" section of its website, which includes more than 1,000 articles, questionnaires, and videos available on the XTB Academy section (many of which relating to Technical Analysis have been produced by the CFAT or Center de Formation à l'Analyse Technique), a decryption of the daily markets and numerous free online webinars accessible at all from the "Online training" section.

Also, note that XTB publishes many analyzes to inform its customers about the macroeconomic context and help them make the most informed choices possible. In 2022, XTB was also rewarded with excellent results in the prestigious Bloomberg FX Forecast Accuracy ranking, this famous ranking of economic analysts who make the most accurate market forecasts.

Thus, XTB is placed in 2nd position in the G10 category and 3rd in the Majors 13 category. The analyzes made by XTB have proven to be among the best forecasts, particularly on EEC currencies (EURPLN, USDCZK, EURHUF).

The broker XTB also obviously offers several types of trading accounts: limited risk, standard, and Pro which define in particular the maximum leverage effect and the prices. In compliance with the new standards that impose mandatory protection against negative balance, XTB offers accounts that allow retail investors not to have losses greater than they deposit.

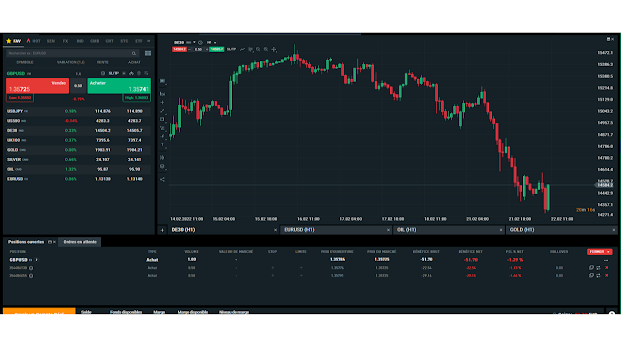

Test of xStation5, the trading platform of XTB

We have tested XTB's in-house trading platform for you: xStation5. The xStation5 platform is a web platform, usable from an Internet browser and therefore requiring no download. It can run on any type of computer (Windows or Mac). An Android and iOS mobile version are also available.

This trading platform was developed by XTB, to meet the needs of their customers.

Source: xStation5

The first obvious observation when starting to use the xStation5 trading platform is XTB's focus on design and ergonomics. Indeed, online brokers who choose to develop their own trading platform generally do so to offer traders and investors a platform that is more pleasant to use than other platforms (vs. the MT4 platform for example).

In terms of features, the xStation5 trading platform brings together all the essentials a trader might need. Thus, we can highlight the existence of a technical analysis interface with a large number of tools and indicators, a complete economic calendar, a news feed, and a “screener” for stocks.

What we liked about the xStation5 platform is the ease and speed with which it is possible to get to grips with the many features available.

Our advice is as follows, open a demo account for free to test the xStation5 platform and if it suits you, adopt it.

XTB review: what are the prices of the XTB Stock Exchange broker in 2022?

In the fall of 2020, the broker XTB abandoned its cash equity offer launched in 2018 to go further and offer its clients a new equity offer of 0% commissions for a monthly volume of 100,000 euros (then 0.2% above the previous figure).

Concretely, it becomes possible for a private investor to trade stocks but also ETFs from all over the world with 0 fees. XTB's offer in this area is extensive since it concerns more than 2,000 shares from the 16 largest stock exchanges in the world and nearly 200 ETFs.

On the foreign exchange market, the broker XTB offers access to 48 currency pairs and displays reduced spreads from 0.1 pips.

Spreads and financing costs on CFDs at the broker XTB in 2022

XTB offers CFDs with some of the lowest spreads on the market, with no other transaction fees. XTB offered 3 types of trading accounts until 2020, but now there is only one type of account available for French customers. The limited risk account includes the following parameters:

- + than 5400 instruments available;

- leverage up to 30:1;

- variable spreads with a minimum of 0.9 on many assets*;

- protection against negative balances;

- shares & ETFs free of charge.

Funding charges on top of commissions and spreads are additional charges that only apply to CFD positions held after 11:00 p.m., i.e. when the position is held beyond one day.

The online broker XTB, like many online brokers, does not charge custody fees or account maintenance fees. But XTB charges inactivity fees if no order is made in 1 year.

How to open an account with XTB in 2022?

Opening an account with XTB is done online from their website by clicking on the green button at the top right "real account". You will first be asked to enter your email and country of residence. You will then have to choose a password.

You will then be asked to enter your personal information (surname, first name, date, place of birth, nationality), then your contact details.

The XTB broker will ask you about your trading experience on stocks, CFDs, ETFs, Futures, and Options. You will also have to answer questions to test your knowledge.

Finally, you will need to provide information on your level of education, your professional situation, your income, and your investment objectives, and then upload your supporting documents.

XTB Review: Who is XTB for?

Since opening an account with XTB requires no minimum deposit and clients will have access to numerous educational materials, newbie traders and active investors will find XTB a solution that should meet their needs. More experienced investors will appreciate the accessibility to free analysis and news on the Xstation trading platform.

XTB's offer offers a good compromise between active trading and passive investment, so investors who wish to combine the two activities will find a coherent solution at XTB.

XTB Review: Should you choose the XTB broker in 2022?

Would you like to know our XTB opinion because you are hesitating between several brokers? One can indeed legitimately wonder if it is better to choose XTB or another stockbroker. So, XTB or Boursorama? XTB or Bourse Direct? Or even XTB or Degiro?

XTB has an offer that will appeal to active traders as well as long-term investors thanks to:

- on the one hand, CFDs allow active trading on currencies, indices, commodities, and cryptocurrencies with a leverage effect;

- and on the other hand, with the stock and ETF offer a 0% commission on more than 2,000 stocks and more than 200 ETFs.

With its xStation5 platform, XTB provides a comprehensive selection of trading tools that will suit the most knowledgeable investors. Like the MT4 trading platform, it is unfortunately not possible to create custom tools with xStation5, but traders can take comfort in finding tools that will meet 90% of their needs. What should also delight users of this trading platform is the ease of use and the speed of handling.

We also appreciate the very complete point of daily market news produced by the broker. Indeed, every day, the financial experts of XTB France offer macro and technical analyzes and an XTB analyst deciphers economic news and studies its impact on the financial markets through daily LIVE TRADING.

FAQs

What are the advantages of the XTB online broker?

The XTB broker offers a very wide choice of financial instruments: currency pairs (classic and exotic), commodities, stocks, cryptocurrencies, etc. We also appreciate the daily update on macroeconomic news and the many educational materials made available to customers.

Who is XTB for?

XTB can be very suitable for a beginner or experienced trader because of the wide spectrum of financial instruments offered but also the many tools available to better understand them. Casual investors also have an interest in training before using XTB's tools.

What are the prices of XTB?

XTB offers attractive brokerage fees on derivatives. XTB's zero commission pricing on stocks and ETFs is especially attractive for those who want to diversify their long-term portfolio by having short-term trading activities with the same broker and on the same account.

*BITA, CADJPY, CHNcomp, COCOA, COPPER, CORN, DASH, HKcomp, PLATINUM, SOYBEAN, SUGAR, US2000, USDBRL, USDSEK, USDTRY, USDZAR, USFANG, WHEAT, ADABTC, AUDCAD, AUDNZD, AUDUSD, BCHBTC, BITCOIN, BITCOIN CASH, BUND10Y, COFFEE, DE30, DE30 CASH, DSHBTC, EOS, EOSBTC, EOSETH, ETHBTC, ETHER CLASSIC, ETHEREUM, EU50, EURCAD, EURJPY, EURUSD, FRA40 CASH, FRA40, GBPJPY, GBPUSD, GOLD, IOTABTC, ITA40, JAP225, LITECOIN, LTCBTC, NATGAS, NEOBTC, OIL, OIL.WTI, RIPPLE, SILVER, SPA35, STELLAR – Actions Synthétiques : TNOTE, TRXBTC, TRXETH, UK100 CASH, UK100, US100 CASH, US30 CASH, US500 CASH, US100, US30, US500, USDCAD, USDCHF, USDJPY, VOLX

Disclaimer:

All of our information is, by nature, generic. They do not take into account your personal situation and do not in any way constitute personalized recommendations with a view to carrying out transactions and cannot be assimilated to a financial investment advisory service, nor to any incentive to buy or sell instruments.

0 Comments